Digital Transformation at BRD

Contribution

CX strategy and execution for omnichannel platform rollout

Industry

Banking

Like many traditional banks, BRD – Groupe Société Générale, struggled with outdated systems and fragmented architecture, leading to slow delivery and limited market differentiation. To address this, the bank set out to enhance customer engagement and boost employee productivity through a seamless online–offline hybrid experience.

Details

- Role: Digital Transformation Lead CX

- Team: Developers, Designers

- Timeframe: 3-month release + 6 month refinement

- Location: BRD – Groupe Société Générale, Romania

PROBLEM

- Agents used 4 disconnected systems with steep learning curves

- Complex workflows slowed service and increased errors

- Limited cross and upsell opportunities

OUTCOMES

- Cut task time to under 2 minutes

Reduced training costs and errors

- Delivered unified CRM + AI-driven offers

- Created a seamless digital + in-branch experience

+23% Active User Growth fueled by CX-led omnichannel transformation in just one year

BRD’s digital ambitions are structured around several strategic pillars: building a digital-ready architecture (including decoupling, APIs, and services), adopting Agile methodologies to enhance speed and alignment with business teams, implementing DevOps for automation and cloud integration, and creating a flexible, modern workplace for employees.

As Digital Transformation CX Lead at BRD – Groupe Société Générale, I played a pivotal role in the bank’s 2019 digital transformation by spearheading strategic customer experience initiatives that redefined how BRD engaged with its clients. I led the deployment of a unified omnichannel banking platform that seamlessly integrated digital and physical touchpoints across Romania, resulting in a 23% year-over-year increase in active users.

Working closely with cross-functional teams and senior leadership, I built strong executive-level relationships to ensure that customer needs directly informed product roadmaps. This alignment accelerated user adoption, enhanced service personalization, and unlocked new opportunities for upselling and cross-selling—ultimately driving both customer satisfaction and business growth.

BRD collaborated with Backbase and IT Smart Systems to:

- Provide customers with on-demand access to their finances, plus single-click bill payment, easy money transfer capabilities, and more, all in one place.

- Create a hybrid online/offline experience where the customer can choose their touchpoint and get the experience they want, when they want it.

- Offer personalized and direct contact with the bank, with unified advice between digital and in-branch interactions.

- Achieve a high velocity of delivery and continuous updates

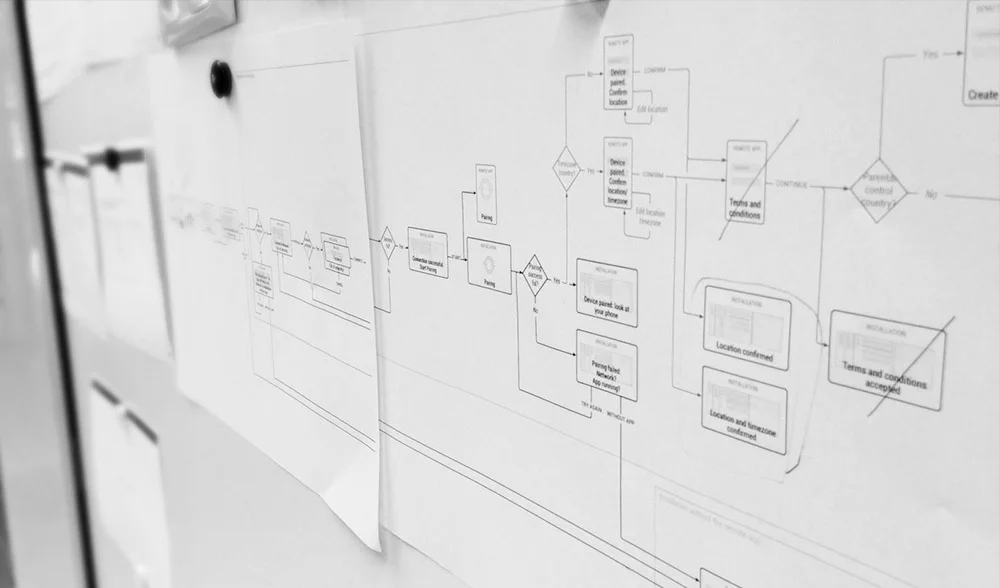

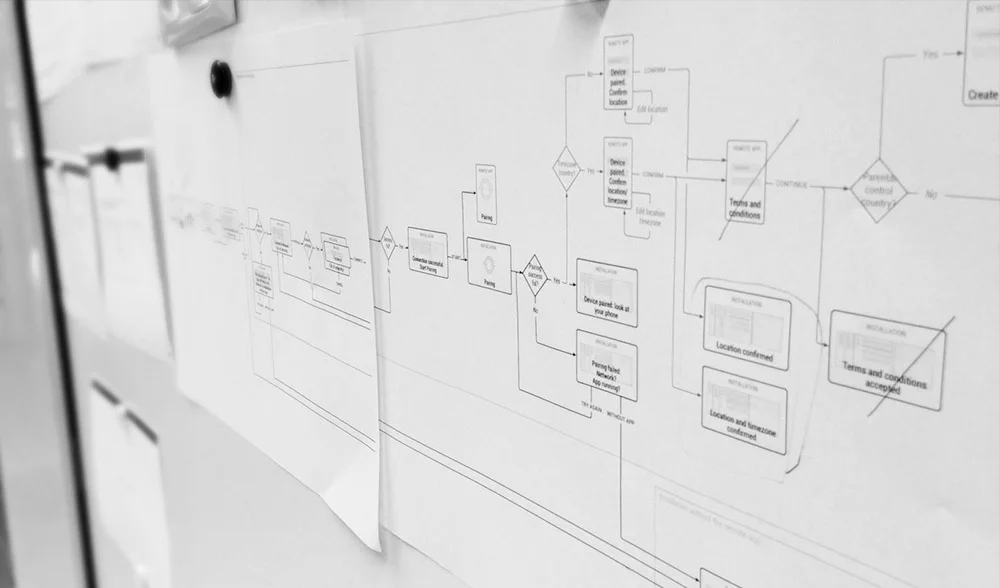

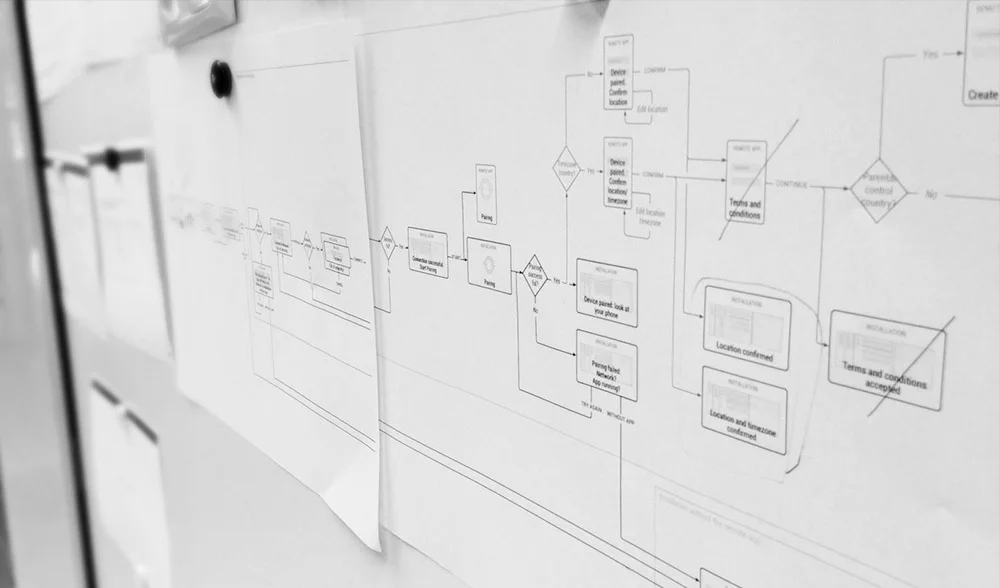

— User flows containing detailed ramifications

A library and a IA system of specifically created to grasp the interaction patterns for TV operative system.

My Contribution as Transformation Lead

- Led strategic customer experience initiatives that powered the deployment of BRD’s omnichannel platform, aligning delivery with customer needs and contributing to a ~23% YoY increase in active users in 2019

- Built and maintained executive-level stakeholder relationships, ensuring customer insights informed product development—boosting adoption, enhancing personalization, and unlocking upsell/cross-sell opportunities

What Was Achieved

- Developed a centralized customer relationship management (CRM) portal that gives employees a 360° view of customer interactions and engagement across all digital and in-branch channels

- Integrated machine learning models to deliver personalized offers tailored to each customer’s buying propensity, risk profile, and behavioral data—resulting in increased digital sales potential

- Unified customer advice across channels, aligning in-branch employee recommendations with digital prompts to ensure consistent, seamless customer guidance regardless of touchpoint

® 2025 Sofia Silva. All rights reserved

sofia@sofiasilva.co | +31 618 570 382 | Linkedin →

Digital Transformation at BRD

Contribution

CX strategy and execution for omnichannel platform rollout

Industry

Banking

Like many traditional banks, BRD – Groupe Société Générale, struggled with outdated systems and fragmented architecture, leading to slow delivery and limited market differentiation. To address this, the bank set out to enhance customer engagement and boost employee productivity through a seamless online–offline hybrid experience.

Details

- Role: Digital Transformation Lead CX

- Team: Developers, Designers

- Timeframe: 3-month release + 6 month refinement

- Location: BRD – Groupe Société Générale, Romania

PROBLEM

- Agents used 4 disconnected systems with steep learning curves

- Complex workflows slowed service and increased errors

- Limited cross and upsell opportunities

OUTCOMES

- Cut task time to under 2 minutes

Reduced training costs and errors

- Delivered unified CRM + AI-driven offers

- Created a seamless digital + in-branch experience

+23% Active User Growth fueled by CX-led omnichannel transformation in just one year

BRD’s digital ambitions are structured around several strategic pillars: building a digital-ready architecture (including decoupling, APIs, and services), adopting Agile methodologies to enhance speed and alignment with business teams, implementing DevOps for automation and cloud integration, and creating a flexible, modern workplace for employees.

As Digital Transformation CX Lead at BRD – Groupe Société Générale, I played a pivotal role in the bank’s 2019 digital transformation by spearheading strategic customer experience initiatives that redefined how BRD engaged with its clients. I led the deployment of a unified omnichannel banking platform that seamlessly integrated digital and physical touchpoints across Romania, resulting in a 23% year-over-year increase in active users.

Working closely with cross-functional teams and senior leadership, I built strong executive-level relationships to ensure that customer needs directly informed product roadmaps. This alignment accelerated user adoption, enhanced service personalization, and unlocked new opportunities for upselling and cross-selling—ultimately driving both customer satisfaction and business growth.

BRD collaborated with Backbase and IT Smart Systems to:

- Provide customers with on-demand access to their finances, plus single-click bill payment, easy money transfer capabilities, and more, all in one place.

- Create a hybrid online/offline experience where the customer can choose their touchpoint and get the experience they want, when they want it.

- Offer personalized and direct contact with the bank, with unified advice between digital and in-branch interactions.

- Achieve a high velocity of delivery and continuous updates

— User flows containing detailed ramifications

A library and a IA system of specifically created to grasp the interaction patterns for TV operative system.

My Contribution as Transformation Lead

- Led strategic customer experience initiatives that powered the deployment of BRD’s omnichannel platform, aligning delivery with customer needs and contributing to a ~23% YoY increase in active users in 2019

- Built and maintained executive-level stakeholder relationships, ensuring customer insights informed product development—boosting adoption, enhancing personalization, and unlocking upsell/cross-sell opportunities

What Was Achieved

- Developed a centralized customer relationship management (CRM) portal that gives employees a 360° view of customer interactions and engagement across all digital and in-branch channels

- Integrated machine learning models to deliver personalized offers tailored to each customer’s buying propensity, risk profile, and behavioral data—resulting in increased digital sales potential

- Unified customer advice across channels, aligning in-branch employee recommendations with digital prompts to ensure consistent, seamless customer guidance regardless of touchpoint

® 2025 Sofia Silva. All rights reserved

sofia@sofiasilva.co | +31 618 570 382 | Linkedin →

Digital Transformation at BRD

Contribution

CX strategy and execution for omnichannel platform rollout

Industry

Banking

Like many traditional banks, BRD – Groupe Société Générale, struggled with outdated systems and fragmented architecture, leading to slow delivery and limited market differentiation. To address this, the bank set out to enhance customer engagement and boost employee productivity through a seamless online–offline hybrid experience.

Details

- Role: Digital Transformation Lead CX

- Team: Developers, Designers

- Timeframe: 3-month release + 6 month refinement

- Location: BRD – Groupe Société Générale, Romania

PROBLEM

- Agents used 4 disconnected systems with steep learning curves

- Complex workflows slowed service and increased errors

- Limited cross and upsell opportunities

OUTCOMES

- Cut task time to under 2 minutes

Reduced training costs and errors

- Delivered unified CRM + AI-driven offers

- Created a seamless digital + in-branch experience

+23% Active User Growth fueled by CX-led omnichannel transformation in just one year

BRD’s digital ambitions are structured around several strategic pillars: building a digital-ready architecture (including decoupling, APIs, and services), adopting Agile methodologies to enhance speed and alignment with business teams, implementing DevOps for automation and cloud integration, and creating a flexible, modern workplace for employees.

As Digital Transformation CX Lead at BRD – Groupe Société Générale, I played a pivotal role in the bank’s 2019 digital transformation by spearheading strategic customer experience initiatives that redefined how BRD engaged with its clients. I led the deployment of a unified omnichannel banking platform that seamlessly integrated digital and physical touchpoints across Romania, resulting in a 23% year-over-year increase in active users.

Working closely with cross-functional teams and senior leadership, I built strong executive-level relationships to ensure that customer needs directly informed product roadmaps. This alignment accelerated user adoption, enhanced service personalization, and unlocked new opportunities for upselling and cross-selling—ultimately driving both customer satisfaction and business growth.

BRD collaborated with Backbase and IT Smart Systems to:

- Provide customers with on-demand access to their finances, plus single-click bill payment, easy money transfer capabilities, and more, all in one place.

- Create a hybrid online/offline experience where the customer can choose their touchpoint and get the experience they want, when they want it.

- Offer personalized and direct contact with the bank, with unified advice between digital and in-branch interactions.

- Achieve a high velocity of delivery and continuous updates

— User flows containing detailed ramifications

AI-Powered Personalization Machine learning models enabled smarter, targeted digital sales at scale

My Contribution as Transformation Lead

- Led strategic customer experience initiatives that powered the deployment of BRD’s omnichannel platform, aligning delivery with customer needs and contributing to a ~23% YoY increase in active users in 2019

- Built and maintained executive-level stakeholder relationships, ensuring customer insights informed product development—boosting adoption, enhancing personalization, and unlocking upsell/cross-sell opportunities

What Was Achieved

- Developed a centralized customer relationship management (CRM) portal that gives employees a 360° view of customer interactions and engagement across all digital and in-branch channels

- Integrated machine learning models to deliver personalized offers tailored to each customer’s buying propensity, risk profile, and behavioral data—resulting in increased digital sales potential

- Unified customer advice across channels, aligning in-branch employee recommendations with digital prompts to ensure consistent, seamless customer guidance regardless of touchpoint

® 2025 Sofia Silva. All rights reserved

sofia@sofiasilva.co | +31 618 570 382 | Linkedin →